News and dates

Find out about our commitment and our upcoming dates and always stay up to date.

First advance flat-rate on 02/01/2019

Explanations of the advance flat-rate

Fondsdepot Bank would like to familiarise you with the subject of the "advance flat-rate" and its taxation with this explanation. The aim here is to generate an understanding of the new tax regulations and sensitise investment portfolio holders to the fact that the advance flat-rate may be subject to taxation at the beginning of the year. According to the legislator, the custodian, i.e. Fondsdepotbank, is obliged to collect the taxes incurred on the advance flat-rate. To make this process as transparent as possible for you, we would like to take this opportunity to inform you.

1. What is the advance flat-rate

In future, investors in an investment fund will in general be taxed at the beginning of each year (for the first time from 02/01/2019) on the basis of an advance flat-rate. The capital gains tax for this standard tax base is calculated by the entity managing the custody account and directly paid to the tax authorities. From the economic perspective, the pre-set standard tax base represents an advance taxation of future value increases of the fund assets. The pre-set standard text base is governed by Section 18 of the German Investment Tax Act (InvStG).

2. How is the advance flat-rate calculated?

Fondsdepot Bank has no influence on the calculation of the pre-set standard tax base. The advance flat-rates are provided to all custodians for each fund by the WM Datenservice®.

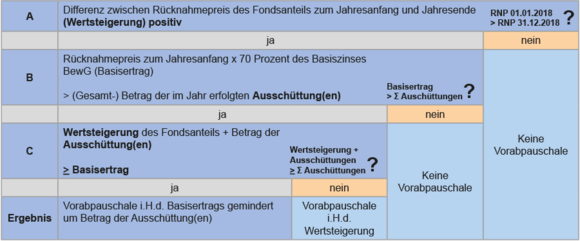

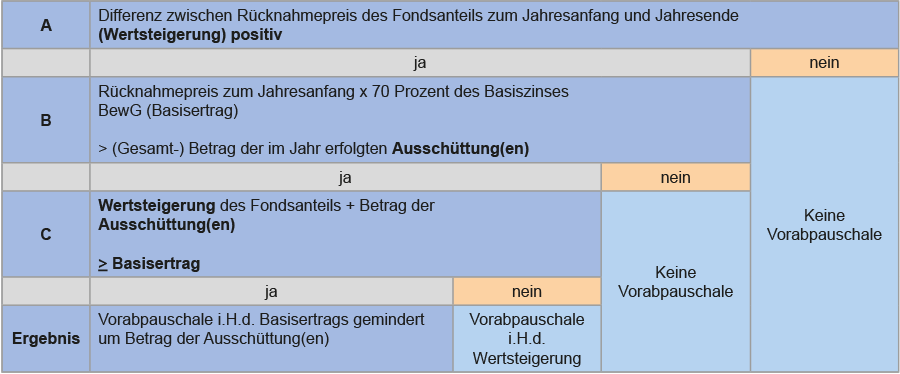

As a matter of principle, WM Datenservice® calculates the pre-set standard tax base for a fund by means of a three-stage procedure.

In the first step, it is checked whether the fund share gained any value in the course of the last calendar year. For this, the redemption price at the beginning of the year is compared with the redemption price at the end of the year. A pre-set standard tax base comes about only if the value of the fund share has increased. If the value of the fund share has not increased, there is no pre-set standard tax base.

If the first step indicates a value increase, the second step is a comparison of the base income defined by the legislator with the total distributions of the fund in the last year. A pre-set standard tax base is established only if the base income is higher than the total distributions of the fund.

The basic yield is defined by law as:

Base income = redemption price at the beginning of the year * base interest rate1 * 70%

If the second step indicates that the base income is higher than the total distributions, the third step will be the determination of the pre-set standard tax base. If the value increase of the fund share plus the total distributions is below the base income, the pure value increase corresponds to the amount of the pre-set standard tax base. In the other case, the pre-set standard tax base corresponds to the base income less the total distributions.

[1] Statutory interest pursuant to Section 18 (4) of the German Investment Tax Act (InvStG)

3. How is the advance flat-rate calculated?

Pursuant to Section 16 (1) no 2 of the German Investment Tax Act (InvStG), the pre-set standard tax rate is referred to as income. The pre-set standard tax base is thus subject to the normal taxation rules for income and sales profits, i.e. it is subject to withholding tax.

3.1. Capital gains tax calculation

Pursuant to Section 18 (3) of the German Investment Tax Act (InvStG) the pre-set standard tax base will be deemed received on the first workday of the subsequent calendar year. In this way, the tax is charged on the "pre-set standard tax base" income. After determination and delivery of the bases of calculation of the advance flat-rate by WM Datenservice®, the custodian will calculate the capital gains tax, solidarity tax and church tax on the basis of the personal data of the portfolio holder or the beneficial owner. This is done under consideration of any partial exemption rates that apply to the fund, any existing exemption orders that have not been fully utilised and any existing loss offsetting pools. The calculated capital gains tax, the solidarity surcharge and any church tax are shown to the customer in a custody account statement.

3.2. Deduction of capital gains tax from the advance flat-rate in the event of future sales

From the economic perspective, the capital gains tax on the pre-set standard tax base represents an advance taxation of future value increases. Therefore, it is offset against the taxation of a sale of the respective shares. On the day of the sale – which may be several years in the future – all capital gains taxes paid so far on the pre-set standard tax base are offset against the tax due on the sales proceeds.

4. When is the advance flat-rate settled?

The bases for calculation of the advance flat-rate are determined by WM Datenservice® per fund and provided to the custodians. The provision of the data for the first fund is expected to begin in early January and be completed before the end of the month.

The capital gains tax on the pre-set standard tax base is always calculated for the fund shares held by the customer at the beginning of the year. Soon after the provision of the pre-set standard tax base data of a fund, Fondsdepot Bank performs the taxation of a customer's custody account portfolio. If a customer holds various funds in his custody account portfolio, the calculation of the capital gains tax on the pre-set standard tab base for the funds may take place at different times.

5. How is the tax on the advance flat-rate collected?

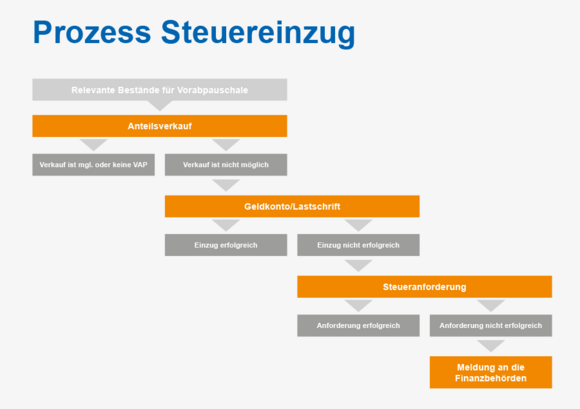

As the calculated capital gains tax on the pre-set standard tax base is a separate business transaction, it cannot be offset against other transactions. The tax thus needs to be collected by the entity managing the custody account. As described below, the collection of the capital gains tax on the pre-set standard tax base at Fondsdepot Bank takes place according to a defined process. After collecting the tax from the customers, Fondsdepot Bank will transfer the collected tax to the responsible revenue office.

5.1. Sale of shares

After receiving the bases for calculating the advance flat-rate for a fund from WM Datenservice®, Fondsdepot Bank will determine the shareholding per fund of the clients and calculate the capital gains tax, solidarity tax and any church tax for each individual client, on the basis of their shareholding and tax situation (see 3.1 Calculation of capital gains tax).

To settle the tax claim, Fondsdepot Bank will sell the required number of shares from the portfolio of the respective fund. Of course, the sale is only possible insofar as no circumstances preventing the sale exist for the fund, the custody account or the portfolio.

Fondsdepot Bank automatically calculates the number of shares to be sold to settle the tax due under consideration of the tax that accrues from the sales transaction executed. This transaction does not require a separate order of the customer. The sale is documented to the customer with a sales custody account statement.

5.2. Direct debit

Usually, the tax on the pre-set standard tax base is collected via direct debit if the shares cannot be sold and Fondsdepot Bank has a reference bank account with a valid SEPA mandate. The customer is notified of the direct debit with the custody account statement for the pre-set standard tax base.

5.3. Tax requirement

The tax request will be sent if the shares could not be sold and the direct debit was not possible. A tax request is a letter requesting the customer to pay the tax calculated for the pre-set standard tax base for a fund within 14 days. The statement sent with the tax request shows the tax due and specifies the account to which the customer needs to pay his tax debt. To enable due allocation of the amount paid, it is important to specify the purpose mentioned in the letter in the transfer.

5.4. Report to Inland Revenue Office

If the tax collection measures mentioned in advance are unsuccessful, Fondsdepot Bank is obliged to report the client with the outstanding tax demand to the tax authorities. The tax authorities will then attempt to collect the tax demand.

6. Preparation options

For the calculation of the tax on the pre-set standard tax base and the collection of the taxes to proceed as smoothly as possible, it is important to understand that the collection of taxes on the pre-set standard tax base is a statutory requirement under the German Investment Tax Reform Act (InvStRefG). The entities managing the custody accounts have been commissioned by the revenue office to calculate and collect the taxes. If no pre-set standard tax base is incurred for a fund, no tax burden will accrue either. A custody account customer can prepare by taking the measures specified below.

6.1. Adjust exemption order

As the pre-set standard tax base is assessed and the taxes due are calculated at the start of a calendar year, an existing exemption order that has not been exhausted would be helpful to minimise the amount of tax collected.

6.2. Check reference account

To collect the tax via direct debit, Fondsdepot Bank needs reference bank details with a valid SEPA mandate. The customer can perform the following preparatory measures:

- if no reference bank account has previously been disclosed to Fondsdepot Bank, this can be submitted.

- if a reference bank account has been disclosed, it should be checked whether the account disclosed still exists and has a valid SEPA mandate.

7. Calculation examples

As of the end of the 2018 calendar year, a custody account has three positions. The officially published applicable base interest rate (2 January 2018) is 0.87 percent.

| Item. | Shareholding / Purchase since/on | Number of shares | Fund type | OP on the day of purchase | RP 01/01/2018 | RP 31/12/2018 | Distribution |

|---|---|---|---|---|---|---|---|

| 1 | 01/01/2018 | 5 | Cumulative | n/a | € 10.00 | € 10.50 | n/a |

| 2 | 15/07/2018 | 50 | Distributing | € 80.00 | € 75.00 | € 78.00 | € 1.50 |

| 3 | 01/01/2018 | 1000 | Cumulative | n/a | € 200.00 | € 201.00 | n/a |

Calculation

Step A

Difference between the redemption price of the fund unit at the beginning and the end of the year (appreciation) positive? [RP 01.01.2018 > RP 31.12.2018]

| Item | Rule | Account | Result |

|---|---|---|---|

| 1 | RP 31/12/2018 higher than on 01/01/2018? | € 10.50 - € 10.00 = € 0.50 Appreciation | AFR "yes" |

| 2 | RP 31/12/2018 higher than on 01/01/2018? | € 78.00 -€ 75.00 = € 3.00 Appreciation | AFR "yes" |

| 3 | RP 31/12/2018 higher than on 01/01/2018? | € 201.00 - € 200.00 = € 1.00 Appreciation | AFR "yes" |

Step B

Redemption price at the beginning of the year x 70% of the base interest rate > (total-) amount of the distribution(s) made in the year?

Basic income = RP at the beginning of the year * (70% of base interest rate)

= RP at the beginning of the year * (0.7 * 0.87%)

= RP at the beginning of the year * 0.609%

| Item | Rule | Account | Result |

|---|---|---|---|

| 1 | Basic income > Total distributions | Basic income: € 10.00 * 0.609% = € 0.0609 / Total distributions: € 0.00 -> Basic income > Total distributions | AFR "yes" |

| 2 | Basic income > Total distributions | Basic income: € 75.00 * 0.609% = € 0.457 / Total distributions: € 1.50 -> Basic income < Total distributions | AFR "no" |

| 3 | Basic income > Total distributions | Basic income: € 200.00 * 0.609% = € 1.218 / Total distributions: € 0.00 -> Basic income > Total distributions | AFR "yes" |

| Item | Rule | Account | Result |

|---|---|---|---|

| 1 | Appreciation + distribution (A+D) ≥ Basic income (BI) | Appreciation: € 10.50 - € 10.00 = € 0.50 / Distribution: None/base income: € 0.0609 -> A+D > BI -> Basic income as basis | AFR = 0.06 |

| 2 | Appreciation + distribution (A+D) ≥ Basic income (BI) | n/a | no AFR |

| 3 | Appreciation + distribution (A+D) ≥ Basic income (BI) | Appreciation: € 201.00 - € 200.00 = € 1.00 / Distribution: None/base income: € 1.218 -> A+D < BI -> A+D as basis | AFR = € 1.00 |

Result

Calculation of the PSTB (without taking loss offsetting balances, exemption orders, church tax and solidarity surcharge into account)

| Item | Rule | Account | Result |

|---|---|---|---|

| 1 | Number of shares * AFR * 25% Capital gains tax | 5 * € 0.0609 * 25% = € 0.076125 | Capital gains tax = € 0.08 |

| 2 | Number of shares * AFR * 25% Capital gains tax | n/a | no capital gains tax from AFR |

| 3 | Number of shares * AFR * 25% Capital gains tax | 1000 * € 1.00 * 25% = € 250.00 | Capital gains tax = € 250.00 |